With the new US administration seemingly applying tariffs at random around the world - with Canada and Mexico the victims today - I thought it would be useful to take a look at the countries Australia export to and import from. Because it will happen to us soon.

Lets have a look.

Why do I care

Well the obvious reason is that, if a tariff was put on us, those exports are now being taxed overseas. This direct effect of tariffs would lead to us selling a bit less and earning a bit less for what we do sell in the US - and insofar as the exchange rate depreciates it may lead to the things we buy from the US getting a bit more expensive.

But there are more than two countries. Understanding who else we sell to tells us where there may be substitute export markets that might limit the cost of the tariffs.

And if tariffs are applied to other countries there are also indirect effects - if it reduces income in the other country, it may reduce demand for the products we sell, hurting exports. Furthermore, if the US market “sets the price” for products then these other countries may substitute to sell them in Australia. The increase in supply would mean we get them at a lower price - a bit of a indirect benefit for us, at least in the short-term.

Exports

So lets make some export graphs.

We are going to go to the trade statistics, and look at merchandise trade by country. The assumption here being that tariffs specifically apply to merchandise trade. Furthermore, we’ll take FOB (Free on Board) numbers rather than the customs figures - as a tariff will apply to this value, not the value including shipping costs and insurance. (Note: Not that I appear to have no choice, given only FOB shows up in the tables I’m looking at)

How do we read this graph? The largest export destination in the 2024 year can be found at the bottom - China. We then read upwards to see the next largest (Japan). This gives us our top 10 export desintations - with an other category capturing everyone else at the top.

The United States is 5th, buying 4.6% of our exports. An extremely cool tool for visualising this stuff is right here - a lot of these exports are meat, given the US is a big market for meat at high prices (held up by strict quotas).

We can sell that meat in other place. But we won’t receive as much money for it.

Looking through these, it looks like Australian export incomes are a lot more exposed to what will happen in Asia. If US tariffs reduce the ability for Asian markets to purchase from our countries, that will be painful. If instead this leads to Asian markets cutting export prices further in a bid to find additional markets there could be some limited - short-term - upside for some Australian consumers.

But it is this effect on Asia - rather than the direct decision to place tariffs on the Australiasian economies - that will be making a lot of people nervous in Australia.

Imports

Now there is talk of Canada applying tariffs back - what is called “retaliation”. If that happens, US exporters may be looking for alternative markets - so it is useful to ask how much of a connection we have with US producers, as they may offer us a good deal.

However, tariffs are coming for Australia too. As a result, the main reason we might want to understand if the US is an important part of Australian imports is due to the exchange rate effects of tariffs.

Even if we don’t impose tariffs in retaliation, the existence of tariffs on our meat exports to the US will lead to a depreciation in the Australian dollar. A weaker dollar would reduce the effect on exporters somewhat, but would pass the burden of tariffs applied to Australian exporters onto Australian consumers.

So lets do this. For imports it appears I have to use the customs value including insurance - so we’ll use that.

How does this look.

Yeah, the United States is a country we buy quite a bit from, sitting at #2 and accounting for 12% of total imports. We especially purchase vehicles and investment machinery from the US - although hopefully people have stopped buying these excessively ugly Teslas that used to be all around Sydney, so maybe Australia’s import exposure to the US is naturally easing.

So what …

Ahhh I just thought this is some interesting context. If I was someone who needed to forecast growth or inflation, I would probably want to think more carefully about the channels we’ve discussed above - and do some empirical work teasing out what will happen.

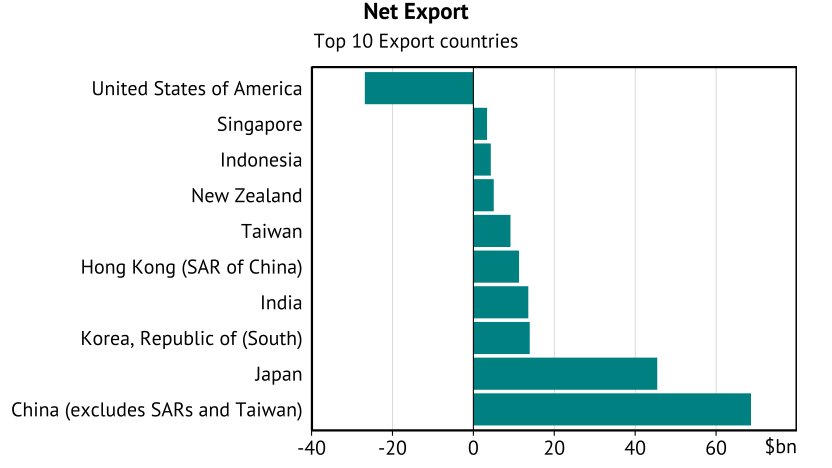

But lets add another picture - tell you what, how about some net export graphs for the largest export destinations.

Given Trump appears to be a 17th century mercantist mixed with a mid-1990s Russian Oligarch - with a sprinkle of Mussolini - the fact that Australia is a net importer from the US might reduce the incentive for him to levy tariffs on us.

And given he barely pays attention to any details, hopefully he doesn’t realise that a VAT and a GST are similar.

If we just stand very still, perhaps we can delay tariffs being applied to the Australian economy. Although given the US economy is likely to collapse given the current looting underway it is probably a good idea to diversify trade markets in any case …