Unrealised losses, high interest rates, and financial market distress

An explainer on bond prices

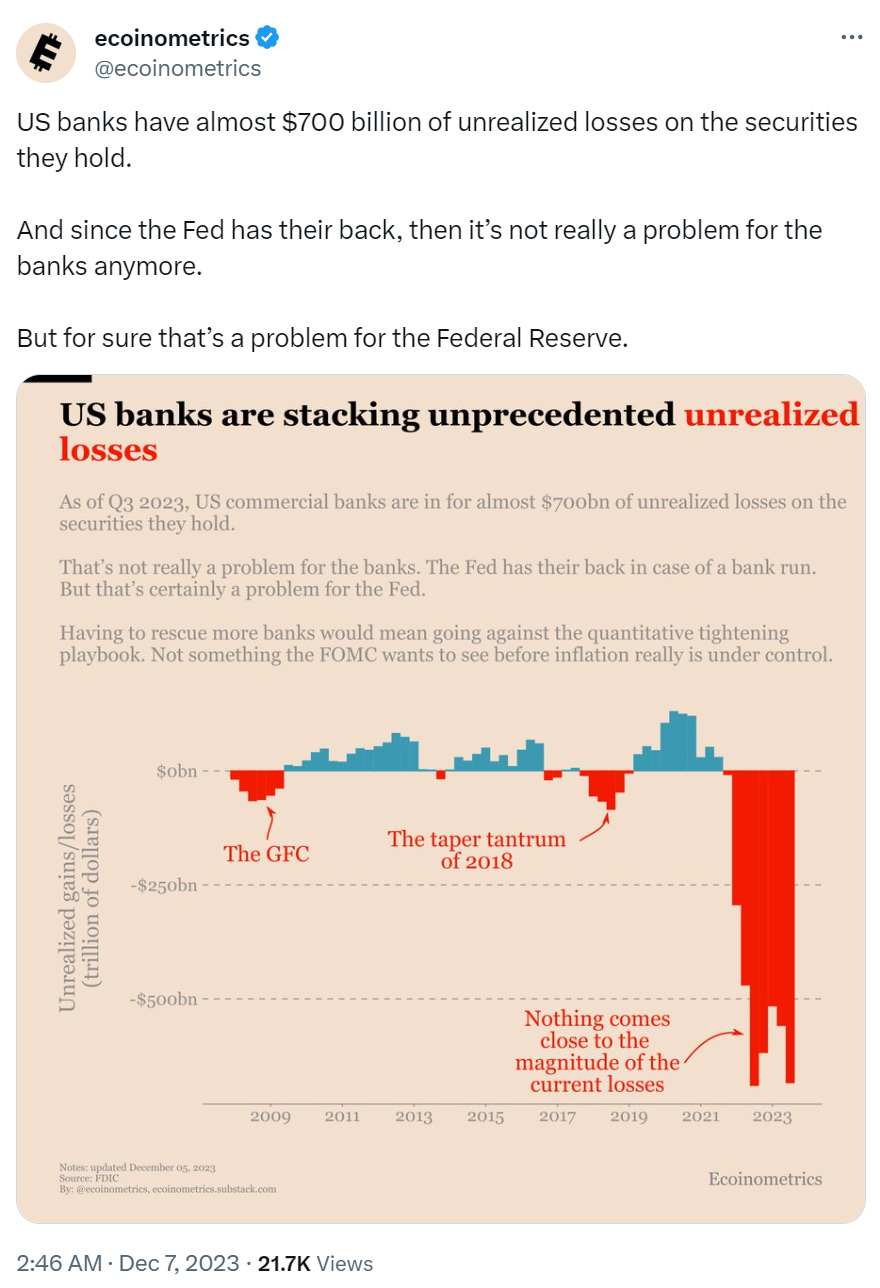

I’ve been seeing a lot of the following around the place:

https://twitter.com/ecoinometrics/status/1732426172473168347

https://twitter.com/AyeshaTariq/status/1734502904487162094

Looks pretty scary right - red columns go lower than during the Global Financial Crisis :O

However, these big red columns are a bit misleading. The data is true - financial institutions holding government bonds have made large unrealised losses on government bonds due to the surge in interest rates. But there is a reason that financial regulations don’t make banks recognise these losses.

Now I don’t know much about much, so I’ll talk through some of the basics of how these things fit together and how I understand it. When there is something important I’ve missed feel free to point it out - but I think after the discussion we’ll at least be in a less misleading place than “giant red bar on Twitter”.

tl;dr: Unrealised losses on government bonds for banks are not really a concern. The real concern would be if there was a genuine increase in bad debt/default. However, the existence of these unrealised losses may make financial markets more sensitive to shocks.

A stylised bond

Imagine a world where you are deciding what to do with a spare $100 you have sitting in your pocket - and you’ve made a decision you want to save it to spend in a year.

In this make pretend world you have four options:

Change your mind and spend it - if the product is durable you could sell it in the future.

Hold the cash.

Pop the cash in a bank and earn interest.

Purchase a fixed-income instrument that matures in a year - i.e. a government bond.

To keep things simple, lets focus on your choice among the last two - say because the things you can buy are really expensive to store or resell, and cash is expected to fall in value through time due to inflation.

If I pop the money in the bank, then a year later I get it back with interest. Lets assume an interest rate of 5%, that means that in 1 year I have $105. Nice.

Now say that there is a bond sitting there that is completely riskless. It costs $100, pays me a $5 coupon during the year, and at maturity will pay me $100 (the face value). Well buying this bond involves saving $100 now and receiving $105 in the future - so it looks like the same thing, with a 5% interest rate.

If interest rates suddenly doubled the equation changes. The doubling in interest rates mean that, if I put the money in the bank I will end up with $110. However, in the bond example I have $105. As a result, I’m not buying the bond - I’m going to save the money.

In fact, a lot of other people will do the same thing - reducing demand for bonds. People will be willing to sell the bond until the yield on the bond (amount received in a year divided by the amount paid now) is the same as the interest rate. As the coupon payment is a fixed amount of income the price of the bond must adjust.

This implies that the price of the bond must decline to around $95.45 (since this amount plus 10% is approximately the $105 received in a year).

Now assume that the interest rate occurred after I had purchased the bond. In this case I am holding a bond that I paid $100 for, but the price has fallen by 4.5%!

In one sense I have lost money - if I went and sold the bond right now to consume right now, I would have less than the $100 I started with.

In another sense, nothing has happened - if I was always going to wait to maturity I am going to end up with $105 in the future, just like I was anticipating before the interest rate change. In this way I haven’t lost anything and my financial situation is purely unchanged.

If bank are just holding these bonds to maturity - in the way they are with other loans - then these losses don’t effect anything, they are just paper losses. However, if they intended to buy and sell the bonds as a means of liquidity management in the here and now this wouldn’t be so good.

Is this a concern?

According to people on twitter the sharp drop in the market value of bonds is a concern. Why? Big red line mate - time to load up specifically on my crytpocurrency.

To be more specific, the inference is that this unrealised loss is still a loss - just like individuals defaulting on loans, this should be seen as a reduction in the value of assets of the firm.

A reduction in the value of assets implies that - at a point in time - a bank will have less available to meet its liabilities (i.e. our deposits at a bank). This could play out in a couple of ways:

Since assets = liabilities + equity a sharp drop in the value of assets may make the net equity in the bank negative - making it insolvent!

Even without insolvency, if concerns about these unrealised losses led an increasing number of individuals to withdraw this would run down banks liquid reserves, and increase the chance they have to sell bonds and realise the loss - leading to a self-fufilling bank run.

The first case is a pretty much non-issue. As noted above, if the bond is held to maturity an unrealised gain or loss is just a “paper” change in value - it does not change the real financial situation of the bank.

The issue only occurs if the bank is forced to realise this loss.

So say there is a sharp increase in demand for funds from depositors, how does this play out.

Seeing that there is an increasing demand for funds, retail banks need to meet this.

If inter-bank lending is also limited (due to other banks feeling similar pressure) the bank will feel tempted to use their bonds to gain access to liquid funds to meet this demand from depositors.

They can do this by borrowing from the central bank, using the government bonds they hold as collateral.

Recently an RBA assistant governor even gave a speech about how all of this works - give it a look!

Summing everything up - these unrealised losses on government bonds for banks that are the topic of twitter are not really a concern. The real concern would be if there was a genuine increase in bad debt/default.

However, in a world of uncertainty where there are certain triggers for default (rising unemployment, structural reform in China and their housing bubble) the concern about unrealised losses can make financial markets a bit more fragile to these shocks - something that financial regulators will be keeping an eye on.